Leave Your Message

As the global economy navigates through the complexities of industrial production and resource management, the Ferro Silicon market stands out as a pivotal segment for investors and buyers alike. According to Dr. Emily Harper, a leading expert in metallurgical processes and market dynamics, "The Ferro Silicon market is not just a reflection of current demand; it is a beacon for future industrial developments, echoing the trends in steel production and renewable energy technologies." This underscores the importance of understanding the evolving trends and insights that will shape the market landscape by 2025.

With a growing emphasis on sustainability and efficiency in production, the Ferro Silicon sector is experiencing significant transformations. As we approach 2025, stakeholders must be adept at recognizing how changes in global supply chains, technological advancements, and regulatory landscapes impact this crucial alloy. Investors and buyers are called to stay informed and agile, as shifts in the Ferro Silicon market can lead to new opportunities and challenges. The interplay of these factors will not only influence pricing and supply dynamics but also dictate the strategic decisions that investors will make in this vital industry.

The Ferro Silicon market is poised for significant growth in 2025, driven by increasing demand in the steel and aluminum industries. According to industry reports, the global Ferro Silicon market is forecasted to reach approximately 6 million tons by 2025, growing at a compounded annual growth rate (CAGR) of over 5% from 2022. This upsurge is attributed to the rising consumption of steel in construction and automotive sectors, where Ferro Silicon is crucial for deoxidizing and improving the quality of steel.

Key statistics also reveal that Asia-Pacific continues to dominate the Ferro Silicon market, accounting for over 60% of the production share. With countries like China and India ramping up their steel manufacturing capacities, the demand for Ferro Silicon is expected to rise correspondingly. Additionally, European markets are seeing a resurging interest in Ferro Silicon as part of their push for more sustainable industrial practices, with renewables power generation requiring advanced materials that meet stricter environmental standards. The growing focus on high-grade Ferro Silicon production, with purity levels reaching 75% and above, is another trend that investors and buyers should closely monitor as they navigate this evolving market landscape.

The global ferro silicon market has experienced notable fluctuations in demand trends from 2021 to 2025, driven by several key factors. Post-pandemic recovery has played a significant role in increasing industrial activities, particularly in the steel and aluminum industries, which are the primary consumers of ferro silicon. As infrastructure projects ramp up in various regions, the need for high-quality steel has surged, thereby elevating the demand for ferro silicon, an essential alloying agent that enhances the strength and quality of the metal.

Moreover, the transition towards more sustainable industrial practices is shaping demand dynamics. The push for green technologies and the rising emphasis on carbon reduction in steel production processes have heightened interest in ferro silicon due to its ability to lower emissions when used as a deoxidizer. As a result, industries are increasingly seeking alternatives that not only fulfill their production requirements but also align with environmental sustainability goals. These changing preferences indicate a shifting landscape in the ferro silicon market, with buyers looking for suppliers that can meet both their quality and sustainability standards.

The ferro silicon market is largely influenced by several key industries that drive its demand and growth. Primarily, the steel industry stands as a significant consumer of ferro silicon, as it is essential for steelmaking. The alloying agent enhances the strength and flexibility of steel, making it a vital component in construction and manufacturing processes. With the global push towards infrastructure development and urbanization, the steel sector's robust performance is expected to bolster ferro silicon market growth in the coming years.

Additionally, the growing automotive and aerospace industries further contribute to the dynamics of the ferro silicon market. As these sectors increasingly demand lightweight and high-strength materials for vehicle and aircraft manufacturing, ferro silicon serves as a crucial ingredient in producing advanced alloys. Moreover, the rise of electric vehicles emphasizes the need for efficient, high-performance materials, thereby expanding the potential applications for ferro silicon. Investors and buyers must monitor these industries closely, as their evolving needs will significantly shape the future trajectory of the ferro silicon market.

As the global demand for ferro silicon continues to rise, driven by its critical role in steel production and aluminum alloys, investors are keenly eyeing the sector for lucrative opportunities. According to a recent industry report by Research and Markets, the ferro silicon market is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 to 2030. This growth is underpinned by investments in infrastructure and construction, particularly in developing regions, which is expected to bolster the demand for high-quality steel and alloys.

However, potential investors must also consider the inherent risks associated with investing in the ferro silicon sector. Volatility in raw material prices, particularly silicon metal and ferrous scrap, poses a significant challenge. A report from Mordor Intelligence highlights that fluctuations in these commodities directly impact production costs and profit margins. Furthermore, regulatory changes and environmental concerns surrounding ferro silicon production can influence operational efficiencies and market access. Investors should conduct a thorough risk and return analysis to navigate these complexities, balancing the promising growth potential with the realities of market dynamics.

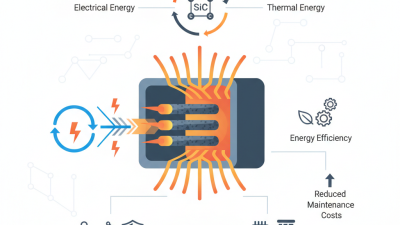

Emerging technologies are significantly reshaping the production processes of ferro silicon, driving efficiency and sustainability in the industry. Innovations such as automation and artificial intelligence are allowing manufacturers to monitor production in real-time, optimizing energy usage and minimizing waste. These advancements lead to improved yield rates and lower production costs, making ferro silicon more accessible to a broad range of industries including steel and aluminum manufacturing.

Furthermore, the integration of environmentally friendly technologies is becoming increasingly essential as global concerns about carbon emissions grow. Techniques such as carbon capture and storage (CCS) and the use of renewable energy sources are being adopted to reduce the carbon footprint of ferro silicon production. These innovations not only enhance the sustainability of the manufacturing process but also position companies to meet stricter environmental regulations and respond to market demands for green products. Consequently, investors and buyers are urged to keep an eye on these technological trends, as they are likely to influence market dynamics and shape the future of the ferro silicon sector.

This chart illustrates the projected growth trends in the Ferro Silicon market from 2023 to 2025, focusing on the influence of emerging technologies on production processes. The data indicates a steady increase in production capacity and demand driven by advancements in steel manufacturing and electronics.